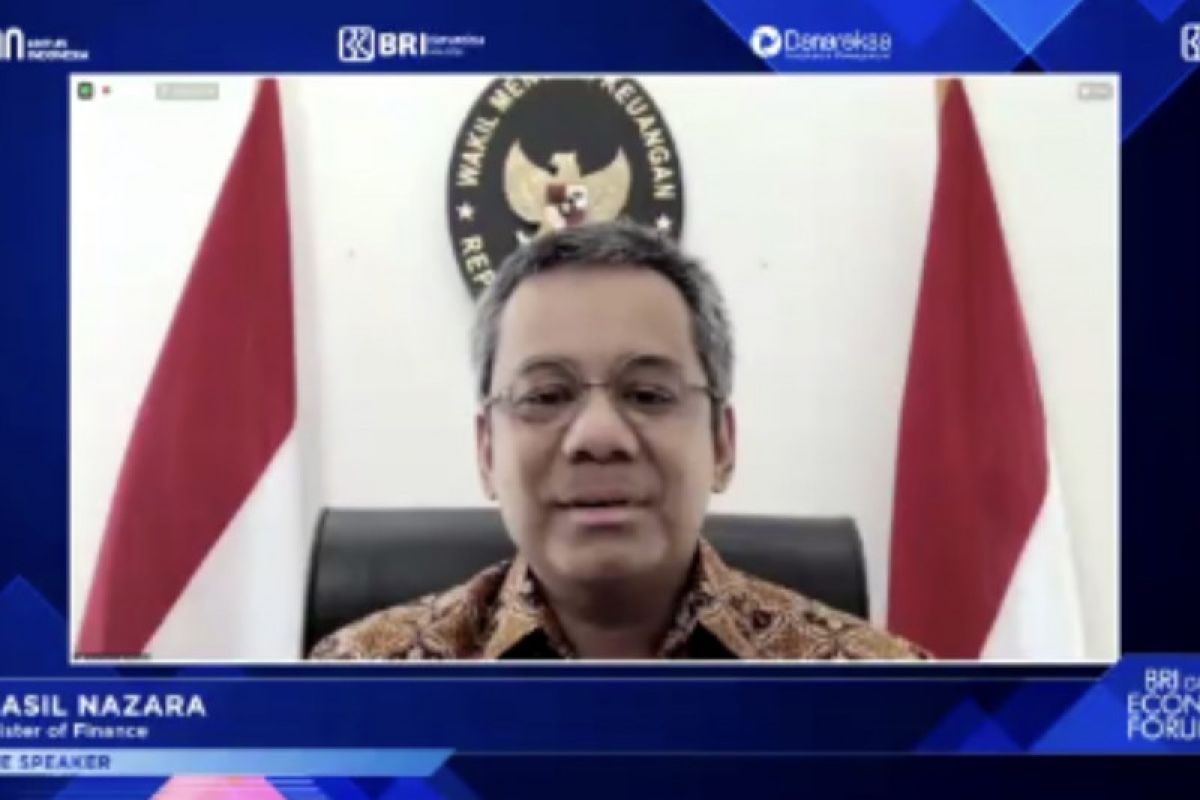

Jakarta (ANTARA) - Deputy Finance Minister Suahasil Nazara highlighted that Indonesia's Sovereign Wealth Fund (SWF), termed the Indonesia Investment Authority (INA), is different from those in other countries.

"The main logic of Indonesia's SWF is different from the SWFs in other countries. The logic of Indonesia's SWF is that we want to invite foreign direct investment (FDI) or foreign funds if I call it," he stated while speaking during the BRI Group Outlook 2021 webinar here on Thursday.

The influx of foreign funds into Indonesia, through the INA, would not be considered as debt but as equity, so that Indonesia would offer a form of stimulus, he noted.

"Foreign funds enter Indonesia not as debt but as equity. Hence, to attract the entry of funds as equity, Indonesia provides a kind of bait," he explained.

Hence, the government had channeled an initial capital of Rp15 trillion into the INA last year, and the amount will be increased to Rp75 trillion this year.

Related news: Jokowi urges Indonesia's SWF to work at full throttle

The government allotted an initial capital of Rp15 trillion through Government Regulation Number 73 of 2020 in the form of cash from the 2020 State Budget.

The additional capital is in the form of state enterprises' assets, and the INA will cooperate with strategic foreign investor partners that facilitate the entry of overseas funds into the country as equity and not as debt.

"This is very important for the future development of financing in Indonesia because we have to watch out for the component of the portfolio entry as debt and the portfolio that enters as equity," he stated.

Nazara is optimistic that the later portfolio as equity would not only be short-term but instead be long-term.

"This is what has been thought that how the SWF will design which projects to be offered as joint venture and which projects that can really become a game changer from long-term development funding," he expounded.

Related news: Jokowi installs members of SWF Supervisory Board